'Frustration and fatigue' hit stock traders in run-up to tariffs

Published in Political News

The Trump administration’s mixed messaging on what new tariffs will be unveiled Wednesday and how they’ll announce them have equities traders flustered as they try to position around the biggest risk confronting the market in years.

“The best way to summarize this trading environment is frustration and fatigue,” said Joe Gilbert, portfolio manager at Integrity Asset Management. “We don’t really have a clear playbook on how to proceed.”

Stocks swung wildly Monday, falling as much as 1.7% before retracing more than half of the losses by midday. The S&P 500 Index is on track for its worst quarter since 2022, as investors brace for President Donald Trump to unveil his plan for sweeping global tariffs in two days. Exactly what it will look like remains a mystery. He’s promised levies on all U.S. trading partners, floated some breaks on certain products or countries, and mulled aiding some domestic industries.

The setup is confounding Wall Street, forcing many traders to ditch positions, sell risk for the relative security of sectors that historically perform well in a recession, or flee stocks altogether.

“We’ve gone from a mindset of focusing on greed and how much money can I make to a mindset of fear and how much money can I lose. And it’s definitely been an emotional change for traders,” said Carley Garner, senior strategist and founder of DeCarley Trading. “Our clients aren’t panicking quite yet, but if stocks bounce back and we start cracking down and making new lows again here in the next couple of weeks, I think panic will set in.”

When Trump was elected, investors expected him to talk loudly about trade. But they also expected him to pull his punches, like in his first term, as he used the S&P 500 as his scorecard. But things have changed. Trump now says he isn’t watching the market and seems unfazed by creating short-term pain, even if it sends the U.S. economy into a tailspin.

‘You can’t price it’

Larry Fink, chief executive officer of BlackRock Inc., touched on the backdrop in a recent letter to clients.

“I hear it from nearly every client, nearly every leader — nearly every person — I talk to: They’re more anxious about the economy than any time in recent memory,” he wrote, adding that he understands why. “But we have lived through moments like this before. And somehow, in the long run, we figure things out.”

Still, there’s no way to avoid the current market meltdown. Many traders have moved away from risk because the downside is too strong.

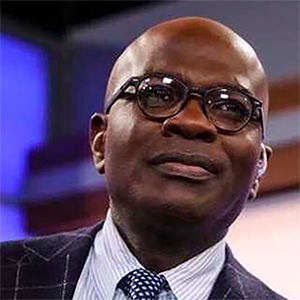

“Clearly traders are already exhausted, and what makes it mentally harder for risk takers is that this uncertainty is very different from risk because you can’t price it,” said Frank Monkam, head of macro trading at Buffalo Bayou Commodities. “If you know someone’s going to punch you, and the punch is coming, you brace for it and you are ready. But what’s happening right now, nobody really saw any of this is coming.”

To make conditions more challenging, even if you think that Trump’s trade policies will ultimately benefit the U.S. economy, there’s a decent chance things will get worse first. Yes, Trump’s April 2 strategy should alleviate some uncertainty. But his tariffs are likely to damage the U.S. economy and hit consumers with higher prices at a precarious moment.

“Trump’s so-called liberation day may feel more like a sentencing day for traders and CEOs alike, as they wait to hear just how tough tariffs may get,” said Max Gokhman, deputy chief investment officer at Franklin Templeton Investment Solutions.

Even so, some investors are betting on longer-term gains. Trump’s levies are supposed to raise tax revenue to close the federal budget deficit, fund another round of tax cuts, and encourage U.S. companies to reshore manufacturing. If you expect that to happen, you also want to be around for the liftoff.

“Surprisingly, a fair amount of clients are still waiting for the good part of all of this to happen,” Gilbert said. “There’s still a glimmer of optimism. But the unfortunate part of it is we don’t know exactly how much damage will have already been done before good things happen.”

Trump put hopes

Some Wall Street pros are hoping that Wednesday ends up being the so-called Trump Put, with the president signaling a win and releasing some of the pressure weighing on the stock market.

“Most politicians don’t want to self-immolate,” said Rhys Williams of Wayve Capital Management. “This strikes me as what’s happening. I doubt he does a complete 180 turn, but potentially Wednesday could be better than feared.”

Of course, the risk is the impact of tariffs could be far-reaching. For example, continued pressure on U.S. companies and consumers could hit earnings reports in the back half of the year, cutting into the biggest driver of stock market momentum. In addition, the big tech shares that were the highest flyers in previous years, may be under additional pressure, according to Bloomberg Intelligence.

“Mega-cap U.S. tech may be at considerable risk, with extremely high valuations and assumptions that margin moats will remain intact,” Gina Martin Adams, Bloomberg Intelligence’s director of equity strategy and chief equity strategist, wrote in a note on Monday. “Companies with high facilities exposure and elevated cost of goods sold outside the U.S. face the greatest direct threats in the short run, while those with elevated revenue exposure are not immune.”

The pressure on these stocks marks a key difference from other recent downturns, when the the so-called Magnificent Seven group were considered havens, powering returns and posting strong earnings regardless of what was happening around them. With the group down more than 17% to start the year, now may seem like a decent time to snag some of those shares a discount, the risk is rather than buying a dip, investors are trying to catch a falling knife.

“Do I wish I’d sold everything on January 22nd?” Williams asked rhetorically, referring to the S&P 500’s post-inauguration rally. “The answer is yes.”

_____

(With assistance from Anya Andrianova.)

_____

©2025 Bloomberg News. Visit at bloomberg.com. Distributed by Tribune Content Agency, LLC.

Comments