Justin Fox: Government contracting is an easy but elusive target

Published in Op Eds

Of all the things Elon Musk’s Department of Government Efficiency is trying to do in Washington, putting the squeeze on government contractors is generating the least popular backlash. There’s a widespread and seemingly bipartisan belief that, as tech entrepreneur and Obama administration veteran Josh Miller put it on X a few weeks ago, “the most wasteful work & spending” in government is “done by for-profit contractors & consultants.”

The Trump administration agenda for federal procurement is certainly ambitious. DOGE has been canceling contracts right and left. The new federal acquisition service commissioner at the General Services Administration has been pressing the biggest contractors to justify their work and is acting to centralize federal procurement at the GSA in hopes that this will drive down costs. The administration has already canceled several Biden administration executive orders related to contracting and aims to overhaul and slim down the Federal Acquisition Regulation that governs procurement. “This is a sea change of monumental consequences,” said James F. Nagle, a government-contract-law expert at Smith Currie Oles in Seattle and author of "A History of Government Contracting."

Financial markets see it as a big deal, too, with the market capitalization of Booz Allen Hamilton Holding Corp., the closest thing to a pure-play federal contractor among publicly traded companies (99.2% of its revenue over the past four quarters came from the US government), down by more than $10 billion, or 43%, since Election Day in November.

It’s harder to say, though, whether this “sea change” will actually have a lasting impact on Washington’s dependence on contractors. Federal contracting is such a vast and complex field that it can be difficult to say much of anything intelligent about it, but some history and data can at least put the current moment in context. Nagle again: “While Booz Allen Hamilton and the other government contracts are going to take a hit in the short run, I think a lot of those companies will do better in the long run.”

Paying private businesses to accomplish government tasks has been the norm here since before there was a US government — Nagle’s "History of Government Contracting" starts with the French and Indian War of the 1750s and 1760s — and while procurement spending has waxed and waned it has never come close to going away. In recent decades such spending has tended to go up in Republican administrations and fall in Democratic ones, mainly because the Department of Defense does the majority of it and defense spending usually goes up under Republicans. This time around, DOGE’s emphasis on reducing headcount at government agencies and shutting things down that may eventually have to be reopened could also generate new work down the road for contractors.

Federal government contracting in the US was a $771 billion business in the 2024 fiscal year, according to Bloomberg Government’s contracts database. Adjusted for inflation, that’s slightly lower than in the 2023 fiscal year but on the high side for the past quarter century.

Putting together a consistent picture of pre-2000 government contract spending is harder, but numbers I’ve culled from a 2000 General Accounting Office (since renamed Government Accountability Office) report and a 1983 law review article by US Senator William Cohen allow one to go back at least to 1972, which reveals that real spending on contracts is higher now than in the 1970s through 1990s.

Of course, federal spending and US gross domestic product have grown faster than inflation since the 1970s as well. Expressed as a percentage of either, procurement spending is lower than in the 1970s and 1980s. But its share of the ever-shrinking share of federal spending considered “discretionary” — that is, it’s appropriated by Congress each year and not tied up in “mandatory” programs such as Social Security and Medicare — has held reasonably steady.

One thing that all these different ways of measuring procurement spending show is that it fell in the late 1980s and 1990s and rose sharply in the 2000s. The decline was a combination of defense cutbacks after the Cold War, bipartisan efforts to reduce the budget deficit and a political crackdown on contracting abuses that Nagle dubs in his book the “criminalization of government contracting.” This combined with a decades-long buildup of laws and regulations governing contractor behavior to make federal contracting “much less attractive,” he wrote.

Efforts to make life simpler for federal contractors began to gain traction in the mid-1990s, and in the wake of the Sept. 11, 2001, terrorist attacks came a huge increase in spending on defense and other security efforts (the Department of Homeland Security was created in 2002). Booz Allen, founded as the Business Research Service in 1914, was a big beneficiary — intelligence-contractor-turned-whistleblower Edward Snowden worked there — and spun off its corporate management consulting business in 2008 (it is now the Strategy& division of PwC) to focus entirely on government work.

Defense procurement spending then fell under Barack Obama and rose during Donald Trump’s first term, following the usual partisan pattern, but over the past five years overall spending has remained high despite a slight pullback by the Defense Department. In the 2024 fiscal year, nondefense procurement spending made up 38% of the total, up from 27% in 2008 and 18% in 1985.

Which nondefense departments are doing the spending? The big three in 2024 were Veterans Affairs, Energy, and Health and Human Services, all of which experienced big increases since 2019.

What are they spending it on? “The VA was paying for PowerPoint slides and meeting notes, for the watering of plants, and consulting contracts to do the work that we should be doing ourselves,” the new secretary of veteran affairs, Doug Collins, said recently. Fine, but those things add up to a lot less than $67.6 billion.

The three biggest recipients of VA contract spending in the 2024 fiscal year, if I’m reading the data on USASpending.gov correctly (delving into federal contract data has made me a lot more understanding of the many errors DOGE makes in estimating the savings from canceling contracts) are QTC Medical Services, a division of Leidos Inc.; Optumserve Health Services, a division of UnitedHealth Group Inc.; and Veterans Evaluation Services Inc. They all do VA medical disability exams, while Optumserve also runs VA Community Care Networks in 36 states. No. 4 is Booz Allen Hamilton, which works with the VA on, among other things, upgrading its digital capabilities. Next is Dell Federal Systems, the former Perot Federal Systems, which also provides various information technology services. And so on.

The large amount of federal procurement spending that now goes to IT services is a source of frequent comment and complaint in and outside of government. Tech entrepreneur and DOGE Internal Revenue Service embed Sam Corcos said on Fox News that the agency’s $3.5 billion annual IT operations budget and $3.7 billion modernization effort were “way beyond any reasonable cost for what you would expect at a private company for this.” But that’s not really true: The annual IT budget at JP Morgan Chase & Co. is $17 billion, about half of which is earmarked for modernization; at Bank of America Corp. the total is $12 billion, of which $4 billion goes to “new technology initiatives.” Nationwide, employment in what government statisticians call computer systems design and related services has doubled since 1999, and real output is up fivefold. It’s not just the federal government that is spending a lot on this.

Can it get by with spending less? Sure. It’s possible that DOGE will be able to cancel enough contracts and the GSA will be able to renegotiate enough of them to make a serious dent. But given the amount of wreckage DOGE has been leaving in its wake, a lot of new contractors may have to be hired to clean it up.

____

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

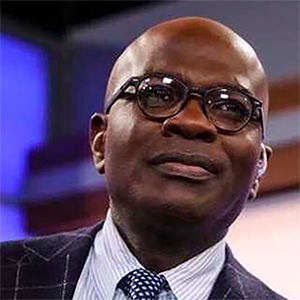

Justin Fox is a Bloomberg Opinion columnist covering business, economics and other topics involving charts. A former editorial director of the Harvard Business Review, he is author of “The Myth of the Rational Market.”

©2025 Bloomberg L.P. Visit bloomberg.com/opinion. Distributed by Tribune Content Agency, LLC.

Comments