Senior couple seeks advice on current estate plans

Q: My husband and I are in our mid-70s. I am trying to get our affairs in order so our sons will not have trouble when we do pass away. I have done two things as suggested by my retired attorney brother. First, we have gone through all of our accounts (banks, investing accounts, retirement plans and Treasury Direct account). We checked each account and set up a primary beneficiary and also contingent beneficiaries.

We are also in the process of doing a transfer on death instrument (TOD) on our house, naming our three kids as the owners once we die. My brother suggested that we go the TOD route with our home and set up primary and contingent beneficiaries on our accounts. He thought this would be simple and didn’t think we needed to set up a living trust. The end result would be the same, he said.

Our home is worth around $1 million and our accounts contain approximately $3.5 million. Do you think we should consider setting up a trust, or are we OK with what we have done?

A: You’ve got a significant estate, and you’ve taken some savvy steps to make sure your affairs are in order. But we find ourselves conflicted over which way you should go from here. In the short term, we think your brother is right that if you and your husband were to die today, your home and other assets would flow to your kids. On the other hand, you don’t want to mess up a $4.5 million estate.

Under existing federal estate tax laws you and your husband appear to be well below the threshold where the Internal Revenue Service would expect an estate tax from you. When it comes to a state tax return, it depends on where you live. In states without an estate tax, you wouldn’t need to file anything. In a state like Illinois, you may need to file a return but not owe anything. In other states, there would be an estate tax return and also a tax bill to be paid.

The real question is whether you can avoid probate court with what you’ve done. Sam received a call from a client recently that is in a similar position. While Sam is not an estate planning attorney, he had a series of questions for his client to consider that we think you should also consider:

You have three kids, what happens if one of your children dies before you do? If you don’t change anything, your other two kids will get all that you own. Is that what you intend? Or, would you want your deceased child’s wife and your grandkids to get their parent’s share? One additional item to consider is whether one child will need more money than the others because of circumstances or the industry in which they work. Would any of your children need additional funds to care for disabled children or have special needs or whether you want to have funds only used for educational or health purposes?

There are a number of milestone life changes that can occur at any time that you can’t control with a beneficiary designation in your accounts and even less through the use of a TOD.

To review, a TOD is a document that is filed or recorded with the office that handles filings or recordings of real estate documents where your home is located. The document states that upon your death, you designate one or more people to become owners of your property.

When and if you decide to make changes, you have to record or file a new TOD and indicate that your prior TOD is no longer valid and should be replaced by the new TOD you are filing or recording. In some locations, you not only have to have an attorney prepare the TOD for you, but you might also have to pay to file or record the document along with any other fees that might be required.

In some municipalities, you might have to pay a transfer tax or municipal fee to record the document. So, the TOD might cost you several hundred dollars to get done; and if you change it several times, you might end up paying quite a bit of money for the limited flexibility that the TOD gives you in the estate planning process.

Compare that with a well-prepared trust document that contemplates how to distribute your assets with as many variables as you might want. Say you live to be 100 and outlive your kids, you may or may not want your grandkids to inherit the money you have left. But perhaps you want to provide for your great grandchildren’s educational expenses or to provide for a family fund to pay for the wellbeing of either your kids, grandkids or great grandkids. You can’t do that with a designation on an account, nor can you do that with a TOD. But it would be easy to do with a trust.

This is all food for thought. You have to decide how simple or complicated you want to make your life. But things change and if you take the route of designating beneficiaries in your accounts and filing a TOD, please make sure you update all of your accounts as you go down the road to keep up with your wishes.

Once you consider all of these questions, then you can decide whether you want to talk to an estate planning attorney to set up a trust or take the path recommended to you by your brother.

========

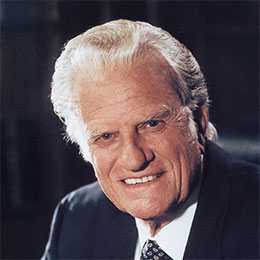

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask” (4th Edition). She is also the CEO of Best Money Moves, a financial wellness technology company. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2025 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.

Comments