10 ways to protect yourself in the digital financial world

We live in a digital world, especially when it comes to money. And, like it or not, you’ll soon be forced to get used to it — especially since the IRS will soon no longer accept or pay out with paper checks!

On March 25, President Trump signed an executive order mandating that all federal departments and agencies end their use of paper checks and switch to electronic payments by September 30. Soon, you’ll be required to make tax payments securely and directly from your bank to the IRS via their website! (See IRS.gov/payments.)

Don’t get defensive here. I’m well aware that a certain generation has no intention of moving into this “modern” digital era. My own (younger) brother will not let me get him a smartphone, and he truly believes that I check my email every hour to get his announcement that he arrived safely home! No texting for him!

My plea: If you have already joined the digital revolution, please don’t give up on your Luddite family members and neighbors. They’re going to need your help as cash disappears, along with paper checks.

Already more than 95% of tax returns are filed electronically, even if your accountant gives you a paper copy! You can’t stave off the digital era of money, so you must learn to handle everything from Venmo and Paypal to credit and banking online, securely.

If, by chance, you’re a 20-something who happened to read this column in a newspaper (does that happen anymore?), it is your duty to drag your grandparents into the digital age. Do your duty. After all, an older person taught you how to drive a car!

OK, here are my top 10 lessons for entering the digital financial era.

1. Practice safe digitalization. Do your important financial things only on your home computer. Make sure you access the internet securely. Have a computer expert (or your grandchild) install a secure Wi-Fi connection, complete with password so your neighbors can’t snoop.

2. Practice secure connectivity. Every bank and financial institution requires two-factor authentication. That means if you sign on to its website, it will instantly text or email you a code to insert on the sign-in page. (Another good reason for texting!)

And banks mean it when they say “Do not share this code with anyone”! Too many seniors are defrauded when they share this code with a fraudster over the phone.

3. Don’t use your phone in public places to access private financial information. No matter who asks you to just “check your bank balance” or “confirm that your account is secure” — don’t go online in Starbucks or outside your bank to access your account! The “air” is insecure!

4. Protect your passwords. Yes, it’s difficult to remember all those passwords — but that’s no excuse for using the same one everywhere! Instead, your younger tech expert will help you get a “password vault” — such as Dashlane or NordPass to securely generate strong passwords and safely keep track of them, auto-filling them when you go to a website.

Now you only have one password to remember — the overall password to your vault. Never give it out!

5. Secure your cellphone. I’ve written about this before. Scammers have developed new sophisticated strategies to “clone” your SIM card — the inner workings of your phone — allowing them to divert those two-factor text authorization messages.

Ask your phone company to provide a separate password for your SIM card. That means every time you turn on the phone you need to insert not only your phone password, but the sim card password.

6. Be careful where you use your card and PIN. Don’t take cash from an ATM in the grocery store unless it is an ATM provided by your bank. Keep one card for use at gas stations, where you’re more likely to be a victim of skimming through devices inserted in the card slot. Reserve one card for your online purchases.

7. Use the new technology on your card. Now, instead of using the keypad to insert your PIN where someone can watch over your shoulder, just tap your card on the reader when you make a purchase. Then put the card away quickly in your RFID-protected wallet.

8. Track your bank and credit card accounts online at least weekly, from your secure Wi-Fi connection at home. You’re looking for balances and unexpected charges. Call your bank or card issuer immediately if you find something suspicious. And please remember to close the browser window that accesses your bank account when you’ve finished looking at it!

9. Track your credit score even if you’re not planning to make a large purchase or buy insurance.

Changes can mean someone else is accessing your credit to borrow money. Your bank or card issuer probably offers credit score checks for free. Or sign up at CreditKarma.com. Check in only on your home computer.

10. Freeze your credit at all three bureaus, by going to AnnualCreditReport.com. Then remember the PIN you created to access your credit report! There is no cost to freeze, and you can temporarily unfreeze at any time if applying for a loan or insurance.

Bottom line: You can’t escape the digital financial era! Your best route is to understand it, use it safely, and to your advantage. That’s The Savage Truth.

========

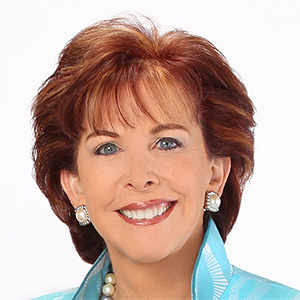

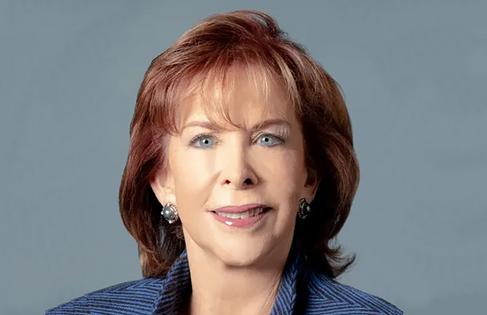

(Terry Savage is a registered investment adviser and the author of four best-selling books, including “The Savage Truth on Money.” Terry responds to questions on her blog at TerrySavage.com.)

©2025 Terry Savage. Distributed by Tribune Content Agency, LLC.

Comments