Jill On Money: Post-election economy

By the time you read this, Election Day will be over, but the economy will continue to do its thing. Although various reports have painted a picture of a solid economy on strong footing, you would not know that if you saw a recent Gallup poll, which found that more than half of Americans (52 percent) say they and their family are worse off today than they were four years ago (39% say they are better off and 9% are about the same).

How can we square the feelings with the data?

Let’s start with the big picture view, represented by Gross Domestic Product (GDP). GDP tallies all goods and services sold in the nation and it expanded by a 2.8% annualized pace in the third quarter, propelled by consumer spending.

The economy is expected to grow by about 2.5 - 2.7% this year, following better-than-expected results in 2022 and 2023, when economists thought that high inflation and interest rates would push us into a recession.

Amazingly, the U.S. has far outperformed other developed nations during the COVID recovery years. U.S. GDP, adjusted for inflation, has grown by 10.7% from Q4 2019 – Q2 2024. That’s almost twice as fast as Canada or the E.U. and three times as fast as Japan.

A separate report underscored progress on inflation. After peaking in June 2022 at an annual rate of 7.88%, the Federal Reserve’s preferred measure of price increases, the PCE Index, has shown significant progress. In September, the PCE Index was up 2.1% from a year ago. Despite the easing of the inflation rate, still-high prices remain a thorn in the side of consumers, which may explain the dismal Gallup Poll results.

Theoretically, if the job market is strong enough to push up wages faster than the inflation rate, workers should be OK. Although the October jobs report was a disappointment (just 12,000 jobs created due in part to the impact of Hurricanes Milton and Helene and the Boeing strike), the labor market has been a key component of the post-COVID recovery. In fact, on average, U.S. workers are making more money today than they were in 2019, even when accounting for inflation.

But the details are tricky. For example, if you are a renter, whose housing costs have skyrocketed by about 25% since 2019, you are feeling a lot more pressure than someone who owns a home with a cheap mortgage rate. Or if you are a family paying for daycare, vs. an individual supporting herself, the costs are drastically different.

As I explained in a recent column, general economic reports do not apply to everyone specifically and it’s very hard for non-wonks to consider inflation adjusted wages as they are confronted with higher prices. Perhaps that’s the disconnect between the data and the Gallup poll.

Very few of us walk down the grocery aisle or pay our insurance bills and think, “Thank goodness I got a pay increase” or “I’m sure glad my 401(k) is up so much.” Nope, we just shake our heads and complain about the cost of everything.

Ben Carlson, author of the blog A Wealth of Common Sense, reminds us that in a growing economy, prices rise, but “inflation in the 2020s has happened in a much more compressed time horizon than in the past. One reason inflation has been so painful to many households, not just financially but psychologically, is that we aren’t used to this kind of economic volatility in such a short period of time.”

The election will be long over when we do adapt — and it will not be due to who is in office.

_____

_____

========

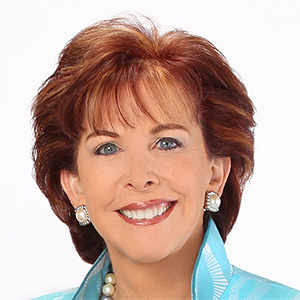

(Jill Schlesinger, CFP, is a CBS News business analyst. A former options trader and CIO of an investment advisory firm, she welcomes comments and questions at askjill@jillonmoney.com. Check her website at www.jillonmoney.com)

©2024 Tribune Content Agency, LLC

Comments