Consumer group sues California insurance commissioner over Fair Plan assessments on state homeowners

Published in Business News

A Los Angeles consumer group has sued California Insurance Commissioner Ricardo Lara to block potential surcharges on home insurance policies statewide as a result of the heavy losses suffered by the California Fair Plan after the Pacific Palisades and Altadena fires.

In a lawsuit filed in Los Angeles Superior Court on Monday, Consumer Watchdog alleges that Lara violated state law when he reached a deal last year with California's property insurer of last resort that would allow its member insurance companies to charge their policyholders for some of the billions of dollars of Fair Plan losses.

The Fair Plan Association is run by licensed property and casualty companies to offer insurance to home and business owners who cannot obtain insurance through the commercial market. The insurers backstop its losses and enjoy its profits based on their market share.

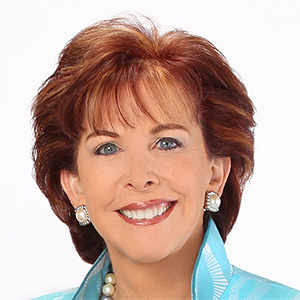

"We look forward to defending the rights and pocketbooks of Californians and stopping this socialization of Fair Plan losses at the public's expense, while the Fair Plan's profits will wholly remain with the insurance companies," Consumer Watchdog staff attorney Ryan Mellino said in a statement.

The Fair Plan declined to comment on the lawsuit. A representative for Lara did not respond to a request for comment.

The Fair Plan has grown rapidly as insurers have pulled out of the state's fire-prone neighborhoods, with its rolls jumping from about 200,000 residential policyholders in 2020 to nearly 560,000 as of March 25. The Los Angeles-based association of insurers has said it expects losses of $4 billion due to the Jan. 7 fires.

A state bill would allow the plan to issue bonds to help cover losses, but last month the plan also received approval from Lara to assess its member companies $1 billion to help pay claims — with consumers possibly on the hook for nearly half of that.

Last year, Lara reached an agreement with the Fair Plan that would allow losses suffered by the plan that were assessed on its member insurers to be recouped by surcharges on the carriers' statewide residential and commercial insurance policies in an "extreme worst case scenario" — such as when a disaster caused the plan to run through its reserves, reinsurance and any catastrophe bonds.

Insurers would be required to cover up to $2 billion in FAIR Plan claims — $1 billion for residential and $1 billion for commercial claims. They could then temporarily surcharge their own policyholders for half of what they are assessed with Lara's approval.

Homeowners would not be surcharged for commercial losses. But the agreement also allows insurers to temporarily surcharge policyholders for 100% of claims in excess of those amounts, with the approval of the insurance commissioner.

Consumer Watchdog called the deal an industry "bailout."

Denni Ritter, vice president for state government relations for the American Property Casualty Insurance Association industry trade group, called the lawsuit a "reckless and self-serving stunt that threatens to ... harm the consumers Consumer Watchdog purports to represent" by pushing the state's "fragile insurance market closer to total collapse."

The Jan. 7 wildfires damaged or destroyed more than 16,000 homes, businesses and other structures, killing at least 30 people.

The Fair Plan said the $4 billion in losses caused by the Palisades and Eaton fires, as well as the Hurst fire in the Sylmar area, wiped out its reserves and $5.78 billion in reinsurance — which includes a $900-million deductible and co-payments that raise the plan's cash payouts to $3.5 billion.

Lara's decision on Feb. 11 to allow the plan to assess its member carriers for $1 billion in losses did not allow them to immediately surcharge their own customers. Lara must approve the surcharges separately. The lawsuit esimates the surcharges could run into the hundreds or thousands of dollars and seeks a court order to stop that.

Consumer Watchdog alleged in its lawsuit that Lara's actions violated state law because nothing in the 1968 statute that created the Fair Plan contemplated such an assessment on policyholders, among other alleged violations of state law.

Lara implemented the new Fair Plan policy last year as part of his Sustainable Insurance Strategy, which seeks to reduce the plan's rolls by giving insurers several policy concessions in the hopes they will write more policies in fire-prone neighborhoods.

Those concessions include allowing them to charge policyholders for the cost of reinsurance they buy to protect themselves from catastrophes. Consumer Watchdog contends in its lawsuit that allowing policyholder surcharges will not give insurers more incentive to write more policies in risky neighborhoods.

The consumer group's legal action is only the latest lawsuit involving the Fair Plan. Last week, 10 plan policyholders in the Palisades and Eaton fire zones filed a tort claim against the plan, accusing it of failing to investigate or properly compensate for smoke damages.

Prior lawsuits have been filed in Los Angeles and statewide with similar smoke-damage claims against the plan.

©2025 Los Angeles Times. Visit at latimes.com. Distributed by Tribune Content Agency, LLC.

Comments